Web3 VC Funding Plummeted 76%: Crunchbase Data

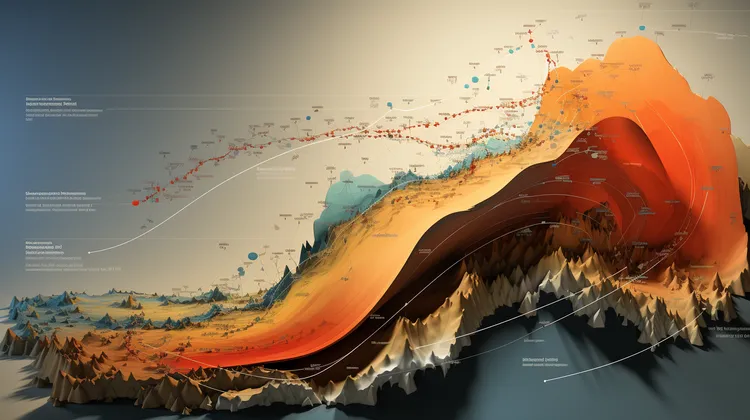

Over the past couple of years, the term Web3 has garnered significant attention and hype within the startup and investor community. With promises of decentralization, blockchain technology, and more autonomous systems, many believed that Web3 would be the future of the internet. Recent data from Crunchbase has revealed a significant drop in venture capital (VC) funding for Web3 startups, causing concerns and questioning the viability of this emerging sector.

According to Crunchbase, VC funding in Web3 startups has plummeted by a staggering 76%. This steep decline has raised concerns among investors, entrepreneurs, and industry experts who were keen on backing the development of decentralized technologies and applications. The drop in funding suggests that there may be a significant loss of confidence and interest in the Web3 sector, potentially hindering its future growth and development.

Several factors could have contributed to this decline. Firstly, the relentless hype around Web3 may have created unrealistic expectations in terms of the speed of development and commercialization of these technologies. Building decentralized systems takes time and substantial technical expertise, which may have caused investors to lose patience and look for more immediate returns on their investments.

Another factor could be regulatory uncertainty. As Web3 technologies often involve cryptocurrencies and decentralized finance (DeFi) platforms, they have been subjected to increasing scrutiny and regulation from governments around the world. The constantly evolving regulatory landscape may have made investors hesitant to dive into a sector that could face legal challenges and barriers to widespread adoption.

The ongoing market volatility of cryptocurrencies, particularly Bitcoin and Ethereum, may have contributed to the decline in funding. Web3 startups often rely on blockchain technology, which is powered by these cryptocurrencies. The fluctuating prices and uncertain market conditions may have made investors wary, leading to a decreased interest in funding Web3 projects.

It is essential to note that this decline in funding may not necessarily signal the end of Web3. While VC funding is a significant contributor to the growth of startups, it is not the sole determining factor. Web3 technologies are still in their early stages, and many innovative projects are being developed through alternative funding mechanisms such as Initial Coin Offerings (ICOs), community-driven token sales, and grants from blockchain foundations.

This decline in VC funding could serve as a healthy correction for the Web3 ecosystem. With less speculative investment and less focus on short-term gains, the sector may now refocus on building robust and scalable technological solutions that can drive real value for users and businesses. This shift in focus could lead to a more sustainable and long-lasting Web3 landscape, which ultimately benefits both investors and end-users.

Despite the drop in VC funding, there are still a few success stories in the Web3 sector. Some high-profile projects, such as decentralized finance platforms and blockchain-based gaming platforms, have secured substantial funding rounds. This demonstrates that there is still investor interest in specific verticals within the Web3 sector, further underscoring the need for startups to hone their value proposition and demonstrate clear use cases.

The recent Crunchbase data revealing a 76% decline in VC funding for Web3 startups raises concerns about the sector’s future. It is crucial to understand the underlying factors contributing to this decline, such as unrealistic expectations, regulatory uncertainty, and market volatility. While this decline may be concerning, it does not represent the end of Web3. Instead, it could serve as an opportunity for the sector to refocus on sustainable growth and building valuable solutions. With alternative funding mechanisms and successful projects in specific niches, there is still hope for the future of Web3 as it continues to evolve and mature.

12 thoughts on “Web3 VC Funding Plummeted 76%: Crunchbase Data”

Leave a Reply

You must be logged in to post a comment.

This just goes to show that the hype around Web3 was all just empty promises.

It’s important to address the underlying factors contributing to the decline in funding. We need realistic expectations and regulatory clarity.

This decline in funding is a clear sign that Web3 is not sustainable in the long run.

The funding drop is a wake-up call for the Web3 sector. It’s time to refocus and prove its value to both investors and end-users.

It’s promising to see that there are still successful projects in specific niches within the Web3 sector. There’s still potential for growth. 🔝

The Web3 sector needs to address the concerns of investors and demonstrate clear use cases to regain their confidence.

The Web3 sector shouldn’t be discouraged by the decline in VC funding. It’s an opportunity to refocus and build a stronger foundation.

The funding drop may signal a shift towards more sustainable growth in the Web3 sector. It’s about building for the long-term.

Despite the decline, Web3 is still an exciting and promising sector. It’s just going through a period of adjustment and recalibration. 🌟

Regulatory uncertainty strikes again! This is why investing in Web3 is a risky move.

The Web3 sector shouldn’t be solely reliant on VC funding. It’s time to explore alternative avenues and build sustainable growth.

Web3 is taking too long to develop, and investors are running out of patience.