Gensler’s Misjudgment of Proof-of-Stake Tokens

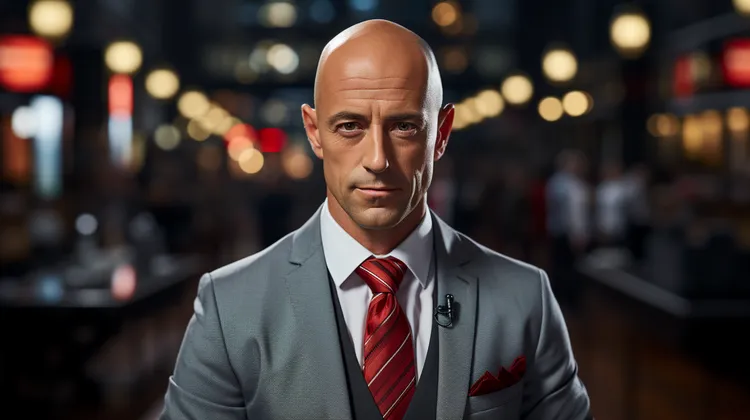

Gary Gensler, the newly appointed Chairman of the U.S. Securities and Exchange Commission (SEC), recently expressed concerns about the regulatory status of proof-of-stake (POS) tokens. Gensler claims that these tokens should be classified as securities and fall under the SEC’s jurisdiction. There are several reasons why Gensler’s stance is misguided and could stifle innovation in the cryptocurrency space.

Firstly, it is important to understand what proof-of-stake tokens are and how they differ from traditional securities. POS tokens, like Ethereum’s upcoming upgrade to Ethereum 2.0, enable token holders to participate in the network’s consensus mechanism by staking their tokens. In return, they earn interest or rewards for helping to secure the network. These tokens are not investments in a company, but rather serve a utility function within the blockchain ecosystem.

Gensler argues that because these tokens generate income for token holders, they should be considered securities. This viewpoint fails to recognize the fundamental differences between POS tokens and traditional securities. Securities typically represent an ownership stake in a company, entitling the holder to a share of profits and voting rights. POS tokens, on the other hand, primarily serve as a means of participating in network governance and securing the blockchain.

Classifying POS tokens as securities would introduce unnecessary regulatory burdens and hinder the development of innovative blockchain projects. The SEC’s regulatory framework for securities is designed to protect investors from fraudulent activities and ensure proper disclosure. While these requirements are essential for traditional securities, they may not be appropriate or practical for decentralized networks that operate on a global scale.

It is also important to note that the SEC has not provided clear guidelines on how POS tokens should be regulated. This lack of clarity creates uncertainty and deters blockchain projects from launching in the United States. Many innovators and developers may choose to take their projects outside of the country where regulations are more favorable, leading to a potential brain drain of talent and innovation.

Gensler’s approach fails to acknowledge that the cryptocurrency industry is a rapidly evolving ecosystem. Many countries are embracing the potential of blockchain technology and adopting supportive regulations to foster innovation. By taking a strict regulatory stance, the United States risks falling behind and missing out on the economic opportunities presented by cryptocurrencies and decentralized finance.

Instead of viewing POS tokens as securities, regulators should focus on striking a balance between consumer protection and fostering innovation. This could involve creating a new regulatory framework specifically designed for cryptocurrencies and blockchain technology. By doing so, the SEC can provide clarity and certainty to market participants, encouraging responsible innovation while still protecting investors.

It is crucial to recognize the benefits that POS tokens bring to the broader economy. Unlike traditional financial systems that rely on centralized intermediaries, blockchain networks offer greater security, transparency, and efficiency. POS tokens enable individuals from around the world to participate in the network and reap the rewards, democratizing access to financial services and creating new economic opportunities.

Gary Gensler’s assertion that proof-of-stake tokens should be considered securities overlooks the unique characteristics and benefits of these tokens. Treating POS tokens as securities would hinder innovation, discourage projects from launching in the United States, and impede the growth of the blockchain industry. Instead, regulators should focus on developing a forward-thinking regulatory framework that fosters innovation while still safeguarding investors. Embracing the potential of blockchain technology will position the United States at the forefront of the digital economy and ensure its long-term competitiveness.

5 thoughts on “Gensler’s Misjudgment of Proof-of-Stake Tokens”

Leave a Reply

You must be logged in to post a comment.

His strict regulatory stance is outdated and fails to acknowledge the benefits of blockchain technology.

The article makes a great point about the evolving nature of the cryptocurrency industry. We need forward-thinking regulations that encourage innovation while still safeguarding investors. Let’s embrace the potential of blockchain technology!

Maybe Gensler should educate himself properly on the unique characteristics and benefits of POS tokens before making such claims.

It’s refreshing to see an article highlighting the benefits of POS tokens and the importance of democratizing access to financial services. Let’s not stifle innovation with misguided regulations.

The article raises valid concerns about the potential brain drain of talent if the United States doesn’t embrace the potential of blockchain technology. Time to step up and foster innovation!