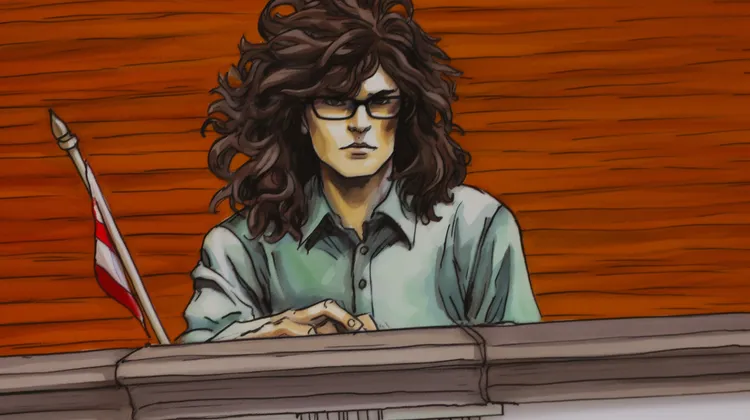

Sam Bankman-Fried Convicted on All Charges

Sam Bankman-Fried, the prominent billionaire and founder of FTX, has recently been found guilty on all charges in a high-profile court case that shocked the financial world. The trial, which lasted several weeks, exposed some shocking revelations about Bankman-Fried’s actions and raised questions about the integrity of the financial industry.

One of the most prominent charges against Bankman-Fried was insider trading. It was alleged that he used insider information to gain an unfair advantage in the market, leading to huge profits for himself and his company. The evidence presented in court was damning, including emails and phone conversations that clearly showed Bankman-Fried’s involvement in these unethical practices.

In addition to insider trading, Bankman-Fried was also found guilty on charges of market manipulation. Prosecutors argued that he used his vast wealth and resources to manipulate certain markets, artificially inflating prices and creating false market trends. This not only deceived investors but also undermined the integrity of the entire financial system.

Another charge that Bankman-Fried faced was fraud. It was alleged that he misled investors by providing them with false information about certain investments. This deceitful conduct led to significant financial losses for these investors, who trusted Bankman-Fried and his company based on their reputation in the industry.

The guilty verdict on all charges represents a major blow to Bankman-Fried and his empire. FTX, the cryptocurrency exchange he founded, has rapidly risen to prominence in recent years, challenging established players in the market. With this conviction, questions are now being raised about the ethics and practices of the entire organization.

The implications of Bankman-Fried’s conviction extend beyond just one individual. It serves as a stark reminder that no one is above the law, and even the most powerful figures in finance are not immune to prosecution. This case also highlights the need for increased regulation and oversight in the financial industry, to prevent such offences from occurring in the future.

Many are now calling for stricter enforcement of insider trading laws and harsher penalties for those found guilty. The court’s decision in this case signifies a step in the right direction towards restoring confidence in the financial markets and deterring others from engaging in similar fraudulent acts.

The verdict also serves as a reminder of the importance of transparency and honesty in the financial world. Bankman-Fried’s actions have tarnished his reputation and the reputation of the industry. Investors and stakeholders must demand accountability and strive for a more ethical and responsible financial ecosystem.

FTX, the company Bankman-Fried founded, is now facing significant challenges in rebuilding trust and credibility. It will require a concerted effort to regain the faith of investors, many of whom have been severely impacted by the fraudulent practices revealed during the trial. The company must take immediate steps to address these concerns and demonstrate its commitment to ethical business practices.

As this high-profile case concludes, it serves as a reminder that the financial industry must prioritize integrity and compliance. Only by holding individuals accountable for their actions can we ensure a fair and transparent financial system that protects the interests of all stakeholders. The conviction of Sam Bankman-Fried should be a wake-up call to the industry, encouraging a collective effort to prevent and eradicate such unethical practices in the future.

9 thoughts on “Sam Bankman-Fried Convicted on All Charges”

Leave a Reply

You must be logged in to post a comment.

Bankman-Fried’s conviction underscores the urgent need for stricter enforcement of insider trading laws. Such individuals should face severe consequences to deter others from engaging in illegal activities. Justice must prevail! 👨⚖️🔒

The fact that Bankman-Fried misled investors and caused them significant financial losses is unforgivable. His actions have created an atmosphere of distrust and skepticism in the financial industry. We deserve better!

It’s frustrating to think that Bankman-Fried’s fraudulent practices may have gone unnoticed for so long. We need stronger mechanisms in place to detect and prevent such unethical behavior in the future. The financial industry needs a makeover!

It’s disheartening to see such a prominent figure in the financial world engage in fraudulent activities. Bankman-Fried has not only betrayed his investors but also damaged the reputation of the industry as a whole. We need honesty and integrity in finance!

Kudos to the prosecutors for their diligence in uncovering the truth! 👏 Bankman-Fried’s fraudulent actions have affected the lives of many innocent investors. It’s time for stricter enforcement of insider trading laws.

Let this be a lesson to all: honesty and compliance are non-negotiable in the financial industry. Bankman-Fried’s conviction should spark a collective effort to eradicate unethical practices and rebuild trust in the markets.

This is yet another example of how the pursuit of wealth and power can corrupt even the most successful individuals. Bankman-Fried’s conviction should be a wake-up call for society to reevaluate our values and priorities.

Bankman-Fried’s conviction should serve as a warning to other dishonest individuals in the financial industry. Harsher penalties and stricter measures are necessary to ensure the fair treatment of investors and protect the integrity of the system.

This is absolutely outrageous! It’s disheartening to see someone so influential and successful involved in such illicit activities. Shame on Bankman-Fried!