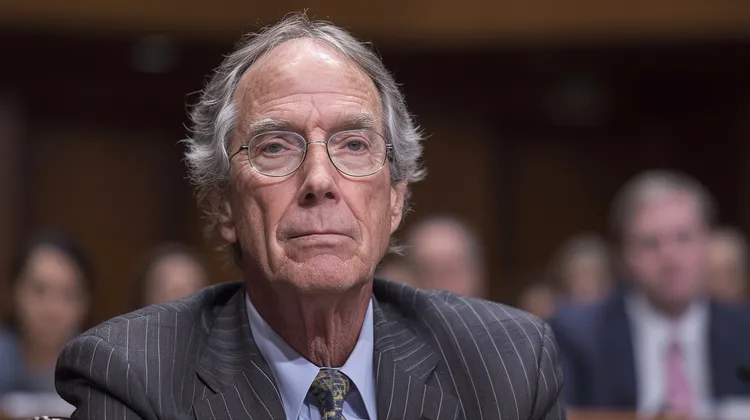

Gensler’s Crypto Warning Before Bitcoin ETF Decision

Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC), has raised the alarm over the potential risks associated with cryptocurrencies as the financial world keenly anticipates the SEC’s decision on whether to approve the first spot Bitcoin Exchange-Traded Fund (ETF) in the United States. The Bitcoin ETF, if approved, could mark a significant milestone by providing a more accessible and regulated vehicle for investors to gain direct exposure to the price of Bitcoin.

In a series of statements and interviews, Gensler has maintained a consistently cautious tone on the subject of cryptocurrency regulation. He has repeatedly emphasized the necessity for investor protections within the highly volatile and often opaque crypto markets. The SEC under Gensler has already taken steps to exert regulatory control over the industry, but the approval of a Bitcoin spot ETF brings with it a whole new set of considerations for the regulatory body.

Gensler’s warnings are primarily focused on the concerns surrounding fraud, market manipulation, and the lack of traditional financial oversight mechanisms in the cryptocurrency space. Despite the decentralization and innovative technology that underpin cryptocurrencies like Bitcoin, the SEC chairman has stressed that these do not exempt crypto assets from the laws and regulations designed to protect investors and maintain fair, orderly, and efficient markets.

The chairman’s stance has been both lauded and criticized by various stakeholders in the cryptocurrency ecosystem. Advocates for the digital currency industry argue that the SEC’s hesitation could stifle innovation and drive cryptocurrency business to other, less regulated markets. Consumer protection agencies and financial analysts often back Gensler’s approach, suggesting that a cautious regulatory framework is necessary given the nascent and frequently tumultuous nature of cryptocurrency markets.

As the date for a decision on the Bitcoin spot ETF looms, many are weighing the potential impacts. Proponents argue that an ETF would lower the barrier of entry for traditional investors, who may be dissuaded by the technical challenges of purchasing and storing cryptocurrencies like Bitcoin. An ETF provides the appeal of trading through a brokerage account without the complications and perceived risks of direct crypto asset management.

Gensler and the SEC’s caution signals a hesitation to move forward without strong regulatory measures in place. The chairman has explicitly outlined the importance of a robust regulatory framework for crypto assets. He has continually called for interagency collaboration, urging Congress to consider new laws that would grant the SEC and other regulatory bodies greater oversight of the crypto market.

This hesitation has led many to speculate on the possible conditions that might accompany an approved Bitcoin spot ETF. It is widely expected that, should the SEC give the green light, it will be accompanied by stringent regulations aimed at consumer protection through greater transparency, accountability, and liquidity requirements.

Gensler’s background as an MIT Sloan School of Management professor specializing in blockchain technology and cryptocurrencies has lent him a unique perspective in regulatory circles. Known for his understanding of complex financial technologies, Gensler is acutely aware of both the potential advantages and the pitfalls of digital currencies. This informed viewpoint has played a major role in shaping the SEC’s approach to crypto regulation during his chairmanship.

While the crypto community remains divided on the benefits and drawbacks of SEC regulation, there is a broad consensus that clarity from the regulatory agency could potentially lead to greater adoption and integration of crypto assets into the wider financial system. An approved Bitcoin spot ETF would be a clear indication that the SEC is willing to engage with cryptocurrencies more directly, albeit with caution and oversight.

It is worth noting that the idea of a Bitcoin spot ETF is not wholly new. Several applications have been submitted and rejected over the years, with the SEC citing reasons that resonate with Gensler’s stated concerns. What sets this current moment apart is that the market has matured considerably, and there is a heightened sense of anticipation that the SEC may be ready to approve an ETF structure that can adequately address its long-standing concerns.

In the lead-up to the SEC’s decision, Gensler’s warnings provide an essential perspective. They serve as a reminder that, despite the excitement surrounding cryptocurrencies and their revolutionary potential, protections against known risks must not be neglected. As the crypto market yearns for broader acceptance and legitimacy, the industry’s willingness to work within a regulatory framework could well be a defining factor in its future growth and sustainability. The approval of a Bitcoin spot ETF, if it comes to pass, could herald a new era of regulated crypto products, and Gary Gensler’s SEC will likely have been instrumental in shaping its safe passage.

3 thoughts on “Gensler’s Crypto Warning Before Bitcoin ETF Decision”

Leave a Reply

You must be logged in to post a comment.

Feels like Gensler is holding back a floodgate of crypto potential just because he can.

Maybe Gensler should realize that imposing too many regulations will just push crypto innovation overseas.

Seriously doubting if Gensler even understands the crypto community. Does he even listen to us?