BlackRock, SEC, Nasdaq Discuss Spot Bitcoin ETF Listing Rules

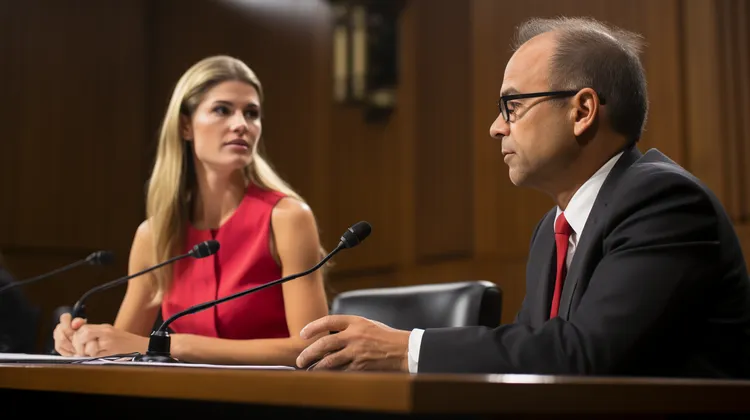

In an industry-shaping meeting, BlackRock, the world’s largest asset manager, convened with representatives from the Securities and Exchange Commission (SEC) and the Nasdaq to discuss the potential framework for listing a spot Bitcoin exchange-traded fund (ETF). This meeting signified a pivotal moment for the cryptocurrency market, as the prospect of a spot Bitcoin ETF has been a topic of intense speculation among investors.

BlackRock, with over $10 trillion in assets under management, is no stranger to the ETF space, having a substantial range of products under its iShares brand. The cryptocurrency space, particularly a spot-based Bitcoin ETF, poses new regulatory challenges. A spot ETF would directly track the price of Bitcoin rather than derivatives or futures, offering a more straightforward exposure to the cryptocurrency for institutional and retail investors.

The SEC, which regulates securities markets in the United States, has yet to approve a spot Bitcoin ETF. Their concern largely revolves around issues such as market manipulation, liquidity, transparency, and the overall stability of the underlying Bitcoin market. The meeting with BlackRock could be a sign that the SEC is open to discussion, but it also underscores the regulator’s caution.

Nasdaq’s role in the meeting was equally crucial, as the exchange would be responsible for listing such a product. With its ability to generate broad investor interest, Nasdaq’s collaboration is central to ensuring that the necessary infrastructure and rules are in place to support a product of this nature. The incorporation of sophisticated market surveillance technologies and frameworks for protecting against market abuse are essential components that Nasdaq could help to facilitate.

BlackRock’s foray into a direct Bitcoin product can be seen as a response to the growing interest and demand from its clients for cryptocurrency exposure. While BlackRock has previously indicated a careful approach to cryptocurrencies, a spot Bitcoin ETF could meet this demand head-on, giving investors a highly accessible investment vehicle that is packaged within a familiar and regulated format.

During the meeting, the potential economic benefits of a spot Bitcoin ETF were laid out. By tapping into the growth of the digital asset space, the ETF could diversify investors’ portfolios, enabling them to hedge against inflation and gain exposure to a new asset class. Such a product could also enhance the overall liquidity of the cryptocurrency market, providing more stability to Bitcoin prices.

The meeting was not without its challenges. The SEC raised questions regarding valuation, custody, and the potential for market manipulation. Unlike traditional securities, Bitcoin does not have a cash flow or a balance sheet that can be examined, making valuation a complex issue. The SEC’s continued dialogue with industry players signals the possibility of overcoming these concerns, but also serves as a reminder of the rigorous standards required for approval.

To this end, BlackRock presented a series of robust measures designed to address the SEC’s concerns. These included comprehensive insurance for assets under custody, advanced blockchain analytics to prevent manipulation, and collaborations with established crypto market makers to ensure sufficient liquidity.

Stakeholders in the cryptocurrency industry eagerly await the outcomes of this groundbreaking meeting. An approval from the SEC for a spot Bitcoin ETF could trigger a wave of institutional investment, solidifying Bitcoin’s place within the broader financial landscape. Such a move would mark a significant endorsement of blockchain technology and its attendant financial products.

For retail investors, the launch of a spot Bitcoin ETF would provide a much simpler means of gaining Bitcoin exposure without the burdens of direct ownership, such as wallet security and private key management. It would also bring Bitcoin to traditional investment platforms, enormously expanding its accessibility.

In the meeting’s wake, both optimism and caution linger in the air. While BlackRock’s initiative could herald a new era in cryptocurrency investment, it also shines a spotlight on the many regulatory and practical challenges that remain. The continued engagement between BlackRock, the SEC, and Nasdaq suggests that dialogue is open and progress is being made, which could eventually result in the alignment of regulatory requirements with market demands.

While the contents and outcomes of the meeting are confidential, industry observers anticipate that detailed proposals and discussions from the session may be reflected in future SEC filings and rule-making notices. For now, the world watches as the triad of BlackRock, the SEC, and Nasdaq continues to shape the framework that could usher in a new chapter for Bitcoin and for exchange-traded funds.

3 thoughts on “BlackRock, SEC, Nasdaq Discuss Spot Bitcoin ETF Listing Rules”

Leave a Reply

You must be logged in to post a comment.

Transparency and regulation in crypto are key, and it sounds like BlackRock’s meeting was all about that.

Talk about innovation! BlackRock, SEC and Nasdaq in one room discussing Bitcoin is just

Totally against this! Why legitimize a currency that’s mostly for speculation and criminals?